Property Insurance for Flood Zones – Owning property in a flood-prone area can be challenging, as the risks of water damage, property loss, and rising insurance costs can be significant. For homeowners and businesses in flood zones, high-risk property insurance is essential for financial security and peace of mind. This guide explains how flood insurance works, what to expect when insuring high-risk properties, and tips to help you make the best decision for protecting your property in a flood zone.

Understanding Flood Zones and High-Risk Areas

Flood zones are areas with varying risks of flooding, as determined by the Federal Emergency Management Agency (FEMA) and other regulatory bodies. Each property in a flood-prone area is assigned a flood zone designation based on the likelihood of flooding. Understanding your property’s flood zone classification is essential, as it impacts insurance requirements and rates.

Flood Zone Classifications

Flood zones are typically divided into three main categories:

- Zone X: Minimal risk. Properties in Zone X are at low risk for flooding and may not require flood insurance.

- Zone B and C: Moderate risk. These areas have a moderate likelihood of flooding and may have lower insurance premiums.

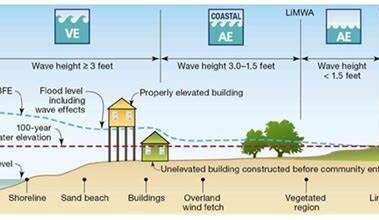

- Zone A, AE, and AH: High risk. Properties in these zones face a higher chance of flooding and may have mandatory flood insurance requirements.

- Zone V: High-risk coastal areas. V zones are coastal flood zones with a high risk of storm surge and waves, requiring higher premiums and stricter building codes.

FEMA’s Flood Map Service can help you find your property’s flood zone and understand the associated risks.

Why Flood Insurance is Essential for High-Risk Properties

In high-risk flood zones, standard homeowners or commercial property insurance policies typically do not cover flood damage. Without flood insurance, property owners may face enormous costs for repairs and replacements following a flood.

The Importance of Flood Insurance in Flood Zones

- Financial Protection: Flood damage can be extensive, affecting foundations, electrical systems, and personal belongings. Flood insurance covers these expenses, providing a financial safety net.

- Compliance with Lender Requirements: If you have a mortgage on a property in a flood zone, your lender will likely require flood insurance to protect their investment.

- Peace of Mind: Knowing you have coverage in place allows you to prepare for potential floods with more confidence.

How High-Risk Property Insurance Works

Flood insurance for high-risk areas can be obtained through the National Flood Insurance Program (NFIP) or from private insurance companies. Each option has its advantages, and understanding the differences can help you make an informed decision.

National Flood Insurance Program (NFIP)

The NFIP, managed by FEMA, is the primary source of flood insurance in the U.S., especially for high-risk areas. The program offers standardized rates, with coverage for both structure and contents.

- Building Coverage: Covers the building’s structure, foundation, electrical, and plumbing systems.

- Contents Coverage: Covers personal property, including furniture, electronics, and appliances.

- Coverage Limits: For residential properties, the NFIP covers up to $250,000 for buildings and $100,000 for contents. Businesses have a coverage limit of $500,000 for both structure and contents.

Private Flood Insurance

In recent years, private insurers have entered the market, offering alternatives to the NFIP. Private flood insurance policies may provide higher limits, more coverage options, and potentially lower rates in some cases.

- Higher Coverage Limits: Private insurers may offer coverage that exceeds the NFIP limits, which is beneficial for high-value properties.

- Additional Perks: Some private policies include living expenses or additional living coverage, which the NFIP does not.

- Potential Cost Savings: In some cases, private flood insurance may be more affordable, though this can vary based on risk factors and location.

Costs of Flood Insurance in Flood Zones

Flood insurance premiums for high-risk areas are generally higher than those for low-risk zones. The cost of flood insurance depends on various factors, including property location, elevation, building structure, and flood zone classification.

Factors Influencing Flood Insurance Costs

- Flood Zone: Higher-risk zones like A and V have higher premiums.

- Property Elevation: Elevated properties or those with flood-proofing measures may qualify for reduced rates.

- Building Characteristics: Older buildings or those with basements may have higher premiums.

- Deductibles and Coverage Limits: Choosing higher deductibles or lower coverage limits can reduce premiums.

The NFIP’s Risk Rating 2.0 system, introduced in recent years, also recalculates premiums based on individual property characteristics, providing a more personalized premium. This system aims to ensure that policyholders pay premiums more accurately reflecting their individual risk.

| Flood Zone | Average Annual Premium (approx.) |

|---|---|

| Zone X | $400 – $800 |

| Zone A | $900 – $2,500 |

| Zone V | $2,500 – $6,000+ |

Note: Premiums can vary widely based on property-specific factors.

Tips for Reducing Insurance Costs in High-Risk Areas

While premiums for high-risk properties can be steep, there are steps you can take to potentially lower your flood insurance costs.

Elevate Your Property

Properties built or retrofitted to sit above the base flood elevation (BFE) may qualify for lower premiums. This can involve elevating the foundation or critical utilities.

Install Flood-Resistant Materials

Using water-resistant materials in construction, such as tile flooring or waterproof wallboard, can minimize damage and lower premiums. Flood openings or vents can also allow floodwater to pass through a building, preventing structural damage.

Improve Drainage Around Your Property

Adding proper drainage systems, grading land away from the building, or installing sump pumps can help reduce flood risk and may impact insurance rates.

Bundle Insurance Policies

Some private insurers offer discounts if you bundle your flood insurance with other policies, such as homeowners or auto insurance. This option isn’t available through the NFIP but may be beneficial for private policyholders.

Shop Around

If you’re considering private flood insurance, compare quotes from different insurers. Some private policies may offer lower rates or better coverage, especially if they account for modern mitigation measures.

Frequently Asked Questions (FAQs)

Is flood insurance mandatory for properties in high-risk areas?

Yes, if you have a mortgage on a property in a high-risk flood zone, lenders typically require flood insurance as part of the loan agreement. Without insurance, you risk losing financial protection and compliance with your mortgage terms.

How can I find my property’s flood zone?

You can check your property’s flood zone by visiting FEMA’s Flood Map Service Center and entering your address. This map provides detailed information on flood zones, helping you understand your property’s risk level.

What is covered by flood insurance?

Flood insurance generally covers structural damage, including foundation, walls, and major systems (HVAC, plumbing). Contents coverage includes personal items such as furniture, electronics, and clothing. NFIP policies, however, do not cover landscaping, temporary housing, or cars.

Can I switch from NFIP to private flood insurance?

Yes, you can switch to a private policy, but it’s essential to ensure the coverage meets your mortgage lender’s requirements. Be aware that rejoining the NFIP later could affect your premium rate, as NFIP policies may be subject to lapse penalties.

What happens if I don’t have flood insurance in a high-risk area?

Without flood insurance, you would be responsible for all repair and replacement costs following a flood. This can lead to significant financial strain, as flood damage can be extensive and costly to repair.

Conclusion: Protecting High-Risk Properties with Flood Insurance

For those with properties in high-risk flood zones, high-risk property insurance is essential for safeguarding against potential losses. With options available through both the NFIP and private insurers, property owners can choose a policy that suits their coverage needs and budget. By understanding flood zones, comparing policy options, and considering mitigation efforts, you can make informed decisions and secure the protection necessary to keep your property safe.