How much is homeowners insurance per year? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Exploring the various aspects of homeowners insurance costs and coverage, this article delves into the key factors that influence pricing, average costs in different regions, strategies to lower premiums, and the types of coverage included in a standard policy.

Factors Affecting Homeowners Insurance Costs

When it comes to determining the cost of homeowners insurance per year, several key factors come into play. Understanding these factors can help homeowners make informed decisions when selecting insurance coverage.

Location

The location of a home plays a significant role in determining insurance costs. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires may have higher insurance premiums due to the increased risk of damage.

Size of the Home

The size of a home, including square footage and number of rooms, can impact insurance costs. Larger homes typically cost more to insure as there is more space to protect in the event of a covered loss.

Age of the Home

The age of a home can also influence insurance premiums. Older homes may have outdated electrical systems, plumbing, or roofing, which can increase the likelihood of claims and raise insurance costs.

Coverage Limits

The coverage limits chosen by homeowners will directly affect insurance premiums. Higher coverage limits provide more protection but also come with higher premiums. It’s important for homeowners to strike a balance between adequate coverage and affordability.

Materials Used in Construction

The materials used in the construction of a home can impact insurance costs. Homes built with fire-resistant materials such as brick or stone may qualify for lower premiums compared to homes with flammable materials like wood.

Proximity to Fire Stations

The proximity of a home to a fire station can also affect insurance costs. Homes located closer to a fire station may have lower premiums due to the reduced risk of extensive fire damage.

Security Features

Homes equipped with security features such as alarm systems, deadbolts, and smoke detectors may qualify for insurance discounts. These features can help mitigate risks and potentially lower insurance premiums.

Average Cost of Homeowners Insurance

When considering the cost of homeowners insurance, it’s essential to understand the average annual expenses associated with it. The average cost can vary significantly depending on various factors such as location, type of home, and coverage options chosen.

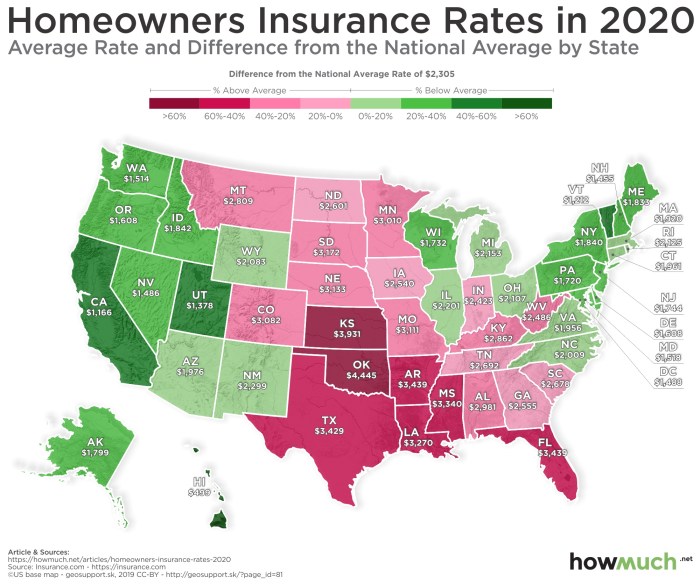

One of the key factors influencing the cost of homeowners insurance is the region in which the home is located. On average, homeowners in the United States can expect to pay around $1,200 per year for insurance coverage. However, this amount can vary greatly depending on the state and even the city within that state.

Regional Disparities in Premiums

In urban areas, where the risk of theft, vandalism, and natural disasters may be higher, homeowners can expect to pay higher premiums compared to suburban or rural areas. For instance, homeowners in densely populated cities like New York or Los Angeles may pay significantly more for insurance coverage compared to those in smaller towns or rural areas.

State-by-State Variations

The cost of homeowners insurance can also vary widely from state to state. States prone to natural disasters such as hurricanes or wildfires typically have higher insurance premiums. For example, Florida, Louisiana, and Texas are known for higher insurance rates due to the increased risk of hurricanes and flooding.

Coverage Levels

Another crucial factor affecting the cost of homeowners insurance is the level of coverage chosen. Basic policies with minimal coverage will naturally have lower premiums, while comprehensive policies that provide extensive coverage for various risks will come at a higher cost.

It’s essential for homeowners to carefully consider these factors when selecting an insurance policy to ensure they have adequate coverage while also staying within their budget.

Ways to Lower Homeowners Insurance Premiums

When it comes to reducing the cost of homeowners insurance per year, there are several strategies you can implement to potentially lower your premiums. By taking proactive steps to mitigate risks and improve your home’s safety features, you may be able to secure a more affordable insurance rate.

Bundling Home and Auto Insurance

One effective way to lower your homeowners insurance premiums is by bundling your home and auto insurance policies with the same provider. Insurance companies often offer discounts to customers who purchase multiple policies from them, which can result in significant savings on your overall insurance costs.

Improving Home Security

Enhancing your home’s security measures, such as installing a burglar alarm system, deadbolt locks, or security cameras, can also help lower your insurance premiums. These security features can reduce the risk of theft or vandalism, making your home less susceptible to potential claims.

Raising Deductibles

Another strategy to consider is raising your deductibles, which is the amount you pay out of pocket before your insurance coverage kicks in. While increasing your deductibles may mean higher out-of-pocket expenses in the event of a claim, it can lead to lower monthly or annual premiums.

Impact of Home Renovations, How much is homeowners insurance per year?

Making improvements to your home, such as updating the roof, plumbing, or electrical systems, can not only enhance your living space but also potentially lower your insurance costs. Newer, well-maintained homes are considered less risky to insure, which could translate to lower premiums.

Installing Safety Devices

Installing safety devices like smoke detectors, fire extinguishers, and carbon monoxide detectors can also help reduce the risk of damage to your home and lower your insurance premiums. Insurance providers often offer discounts for homes equipped with these safety features.

Maintaining a Good Credit Score

Maintaining a good credit score can have a positive impact on your homeowners insurance costs. Insurers may use credit-based insurance scores to determine rates, with higher scores typically resulting in lower premiums. By managing your finances responsibly and improving your credit score, you may be able to secure more affordable insurance rates.

Understanding Homeowners Insurance Coverage: How Much Is Homeowners Insurance Per Year?

When it comes to homeowners insurance, it is crucial to understand the different types of coverage included in a standard policy to ensure you are adequately protected in case of unforeseen events.

Dwelling Coverage

Dwelling coverage is the part of a homeowners insurance policy that helps pay to repair or rebuild your home if it’s damaged or destroyed by a covered peril, such as fire or severe weather. For example, if a tree falls on your house during a storm, dwelling coverage would help cover the cost of repairing the damage.

Personal Property Coverage

Personal property coverage helps protect your belongings inside your home, such as furniture, electronics, and clothing, in case they are stolen or damaged by a covered peril. For instance, if your home is burglarized and your valuables are stolen, personal property coverage would help cover the cost of replacing them.

Liability Coverage

Liability coverage provides protection if someone is injured on your property or if you accidentally damage someone else’s property. This coverage can help pay for medical bills, legal fees, and damages if you are found liable for the injury or damage. For example, if a guest slips and falls on your icy driveway, liability coverage would help cover their medical expenses.

Additional Living Expenses Coverage

Additional living expenses coverage, also known as loss of use coverage, helps cover the cost of temporary living expenses if your home is damaged and deemed uninhabitable due to a covered peril. This can include expenses like hotel bills, restaurant meals, and other costs you wouldn’t normally have if you were living in your own home. For instance, if a fire destroys your house and you need to stay in a hotel while it’s being repaired, additional living expenses coverage would help cover the cost of your temporary accommodations.

In conclusion, understanding the nuances of homeowners insurance costs and coverage is essential for homeowners looking to protect their investment. By exploring the factors affecting costs, average premiums in different areas, ways to reduce premiums, and the types of coverage available, individuals can make informed decisions to secure their homes and belongings.

When it comes to home insurance policies, it’s important to understand what is covered under a typical plan. From structural damage to personal belongings, a comprehensive policy can provide peace of mind for homeowners. To learn more about what is covered under a home insurance policy, check out this informative article.

One crucial aspect of homeowners insurance is coverage for personal belongings. In the event of theft or damage, having the right policy can help replace or repair your items. To delve deeper into homeowners insurance for personal belongings, take a look at this detailed guide.

For homeowners living in high-risk earthquake zones, having earthquake insurance is essential. This specialized policy can cover damages caused by seismic activities, providing financial protection when you need it most. To explore more about earthquake insurance for homeowners, visit this informative resource.