Home insurance replacement cost vs. actual cash value takes center stage in this comprehensive guide, shedding light on crucial aspects that every homeowner should know. Dive into the nuances of these coverage options and make informed decisions to protect your most valuable asset.

Explore the intricacies of replacement cost and actual cash value coverage, and gain valuable insights that will help you navigate the complexities of home insurance with confidence.

Home insurance replacement cost vs. actual cash value

When it comes to home insurance, understanding the difference between replacement cost and actual cash value coverage is essential for homeowners. Let’s delve into the concepts to grasp their significance in protecting your home.

Replacement Cost in Home Insurance

Replacement cost in home insurance refers to the amount needed to replace or repair your property with similar materials and quality in the event of damage or loss. This coverage ensures that you can restore your home to its original condition without factoring in depreciation.

- Insurance companies calculate the replacement cost based on current market prices for materials and labor.

- It provides more comprehensive coverage as it covers the actual cost of rebuilding your home without depreciation.

- Homeowners may need to periodically review their policy limits to ensure they have adequate coverage for potential rebuilding costs.

Actual Cash Value in Home Insurance

Actual cash value, on the other hand, takes depreciation into account when determining the value of your property in case of damage or loss. It considers the age and condition of the property at the time of the incident.

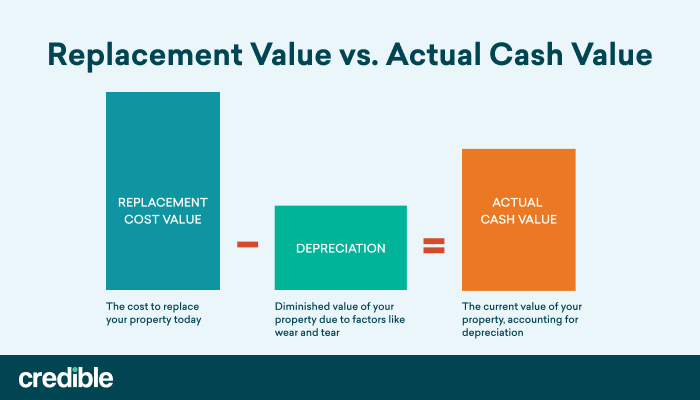

- Actual cash value is calculated by subtracting depreciation from the replacement cost of the property.

- It provides coverage for the current value of your property, taking into consideration wear and tear over time.

- Homeowners may receive a lower payout with actual cash value coverage compared to replacement cost coverage.

Differences Between Replacement Cost and Actual Cash Value Coverage

The key differences between replacement cost and actual cash value coverage lie in the amount of reimbursement homeowners can expect in the event of a claim. While replacement cost coverage offers full reimbursement for rebuilding or repairing your home without factoring in depreciation, actual cash value coverage takes depreciation into consideration, resulting in a lower payout.

- Replacement cost coverage provides more comprehensive protection but may come with higher premiums.

- Actual cash value coverage may be more cost-effective but could leave homeowners financially exposed in case of a significant loss.

Scenarios Where Replacement Cost Coverage is More Beneficial, Home insurance replacement cost vs. actual cash value

There are situations where replacement cost coverage proves to be more beneficial for homeowners, such as:

- After a natural disaster that causes extensive damage to your home, replacement cost coverage ensures you can rebuild without bearing the burden of depreciation.

- For newer homes with high-quality materials, replacement cost coverage ensures that you can restore your property to its original state with no deduction for depreciation.

Factors influencing the choice between replacement cost and actual cash value

When deciding between replacement cost and actual cash value coverage for home insurance, there are several key factors that homeowners should consider to make an informed choice.

Impact of the age of the home

The age of the home plays a significant role in determining whether replacement cost or actual cash value coverage is more suitable. Older homes may have unique features, materials, or construction methods that could be more costly to replace, making replacement cost coverage a better option. On the other hand, newer homes may not have as many specialized components, making actual cash value coverage a more viable choice.

Location and regional factors

The location of the home, as well as regional factors such as weather patterns, natural disasters, and building costs, can greatly influence the decision between replacement cost and actual cash value coverage. Homes in areas prone to wildfires, hurricanes, or other risks may benefit more from replacement cost coverage to ensure full coverage in the event of damage.

Impact of personal belongings and possessions

Personal belongings and possessions within the home can also impact the choice of coverage between replacement cost and actual cash value. Homeowners with valuable items or collections may prefer replacement cost coverage to ensure they can replace these items at their full value in case of a loss. On the other hand, those with minimal personal belongings may find actual cash value coverage to be more cost-effective.

Pros and cons of replacement cost coverage

Replacement cost coverage in home insurance offers several advantages, but it also comes with some limitations that homeowners should consider before opting for this type of coverage.

Advantages of replacement cost coverage:

- Full reimbursement for the cost of replacing damaged or destroyed items: With replacement cost coverage, homeowners can receive compensation for the actual cost of replacing their belongings, without factoring in depreciation.

- Higher coverage limits: Replacement cost coverage typically provides higher coverage limits compared to actual cash value, ensuring that homeowners can replace their property with similar items of equal value.

- Peace of mind: Knowing that you will be able to replace your belongings with new items can provide peace of mind in the event of a covered loss.

Limitations of replacement cost coverage:

- Higher premiums: Replacement cost coverage tends to come with higher premiums compared to actual cash value coverage, which can increase the overall cost of homeowners insurance.

- Requirement for accurate inventory: To ensure proper reimbursement, homeowners with replacement cost coverage must maintain an accurate inventory of their belongings, which can be time-consuming.

- Potential for over-insurance: Without periodic adjustments, replacement cost coverage can lead to over-insuring your property, resulting in unnecessary expenses.

Comprehensive protection with replacement cost coverage:

Replacement cost coverage offers more comprehensive protection for homeowners by ensuring that they can fully replace their property and belongings in the event of a covered loss. This type of coverage eliminates the risk of being underpaid for the true cost of replacing items and provides a safety net for unexpected disasters.

Examples of valuable situations for replacement cost coverage:

- In the event of a fire that destroys your home, replacement cost coverage would allow you to rebuild your home with brand-new materials and appliances, without factoring in depreciation.

- If a valuable piece of jewelry is stolen, replacement cost coverage would reimburse you for the full cost of purchasing a similar replacement, rather than the depreciated value of the stolen item.

Pros and cons of actual cash value coverage: Home Insurance Replacement Cost Vs. Actual Cash Value

When it comes to home insurance, actual cash value coverage offers some benefits but also comes with its own set of drawbacks. Understanding the pros and cons of actual cash value coverage can help homeowners make an informed decision about the type of coverage that best suits their needs.

Actual cash value coverage takes depreciation into account when determining the value of a covered item. This means that the insurance payout reflects the item’s current worth, considering its age and condition. Here are some key points to consider:

Benefits of Actual Cash Value Coverage

- Cost-effective premium: Actual cash value coverage typically comes with lower premiums compared to replacement cost coverage, making it a more affordable option for homeowners.

- Accurate valuation: By factoring in depreciation, actual cash value coverage provides a more realistic value for covered items, ensuring fair compensation in case of a loss.

- Simple claims process: Since the payout is based on the item’s current value, the claims process may be straightforward and less contentious compared to replacement cost coverage.

Drawbacks of Actual Cash Value Coverage

- Lower payouts: The main drawback of actual cash value coverage is that the insurance payout may not be sufficient to fully replace a damaged or stolen item, as depreciation reduces the value over time.

- Aged items devalued: Older items may receive significantly lower payouts under actual cash value coverage, as their depreciation is more pronounced.

- Lack of full protection: Homeowners with actual cash value coverage may face gaps in coverage, especially for high-value items or recent purchases that have not depreciated significantly.

Cost-Effectiveness of Actual Cash Value Coverage

- For homeowners looking to save on insurance premiums, actual cash value coverage can be a cost-effective option that provides basic protection at a lower cost.

- Those with older homes or furnishings that have already depreciated may find actual cash value coverage sufficient for their needs, as the payout aligns with the current value of the items.

Scenarios where Actual Cash Value Coverage May Fall Short

- In cases where homeowners have recently purchased high-value items that have not depreciated significantly, actual cash value coverage may not offer adequate protection, as the payout may not cover the full replacement cost.

- For homeowners with valuable antiques, artwork, or collectibles, actual cash value coverage may undervalue these items, leading to gaps in coverage and potential financial losses in the event of a claim.

In conclusion, the choice between home insurance replacement cost and actual cash value coverage is a critical decision that can impact your financial security in times of need. By understanding the pros and cons of each option, you can tailor your coverage to suit your specific needs and protect your home effectively. Make the right choice today and secure a brighter tomorrow for your most cherished investment.

When it comes to protecting your home from natural disasters, such as earthquakes, having earthquake insurance for homeowners is essential. This specialized coverage can help you rebuild and repair your property in the event of seismic activity. However, it’s also important to consider the overall protection of your home with a comprehensive home insurance policy. This type of policy offers a wide range of coverage, including personal property insurance.

Understanding what personal property insurance covers in homeowners policies can help you safeguard your belongings in case of theft, damage, or loss.

Earthquake insurance for homeowners is a crucial aspect of protecting your property from the devastating effects of seismic activity. By investing in earthquake insurance , homeowners can ensure financial security in the event of a natural disaster. This type of coverage typically includes protection for structural damage, personal belongings, and additional living expenses.

When shopping for a comprehensive home insurance policy, it’s essential to understand the various features available. From coverage for natural disasters to liability protection, a comprehensive home insurance policy offers peace of mind and financial security. Additionally, policyholders can customize their coverage to suit their individual needs and budget.

Personal property insurance in homeowners policies covers the belongings inside your home, such as furniture, electronics, and clothing. Understanding what personal property insurance entails is essential for ensuring that your valuables are protected in the event of theft, damage, or loss. It’s important to review your policy regularly to ensure adequate coverage for your possessions.