Factors that affect home insurance premiums play a crucial role in determining the cost of protecting your property. Let’s delve into the key aspects that influence these premiums and explore how they can impact your insurance rates.

Factors affecting home insurance premiums

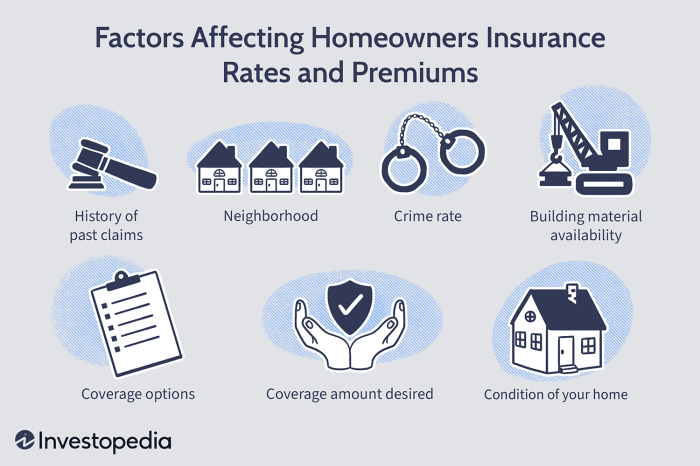

When it comes to home insurance premiums, several factors come into play that can influence the cost of coverage. Insurance companies take various elements into consideration when determining the premiums for a home insurance policy. These factors can vary from one insurance company to another, but some common ones include the location of the property, the age and condition of the home, the coverage limits, and the homeowner’s claims history.

Location

The location of a property is a significant factor that can affect home insurance premiums. Homes located in areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, may have higher premiums due to the increased risk of damage. Additionally, homes in high-crime areas may also face higher insurance costs. On the other hand, homes in safe neighborhoods with low crime rates and minimal risk of natural disasters may have lower premiums.

Property-related factors

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png?w=700)

When it comes to home insurance premiums, several property-related factors play a crucial role in determining the cost of coverage. Factors such as the age and condition of a home, materials used in construction, and specific features can significantly impact insurance premiums.

Age and Condition of a Home, Factors that affect home insurance premiums

The age and condition of a home are important factors that insurance companies consider when determining premiums. Older homes may be more prone to damage and require more maintenance, leading to higher insurance costs. Additionally, homes in poor condition or in need of repairs are seen as higher risks by insurers, resulting in increased premiums to offset potential claims.

Materials Used in Construction

The materials used in the construction of a home can also affect insurance premiums. Homes built with fire-resistant materials such as brick or stone are considered less risky and may qualify for lower premiums. On the other hand, homes constructed with flammable materials like wood may face higher insurance costs due to the increased risk of fire damage.

Features Impacting Premiums

Certain features of a home, such as swimming pools, trampolines, or fireplaces, can impact insurance premiums. These features pose additional risks for accidents or damage, leading to higher premiums to cover potential liabilities. For example, swimming pools increase the risk of drowning accidents, while fireplaces can raise the risk of fire damage, resulting in higher insurance costs for homeowners with these features.

Personal factors influencing premiums

When it comes to home insurance premiums, personal factors can play a significant role in determining the rates that homeowners pay. Factors such as credit score, claims history, age, marital status, and occupation can all impact how much individuals are charged for their coverage.

Credit Score

A homeowner’s credit score is a key factor that insurance companies consider when determining premiums. A higher credit score is often associated with lower risk, leading to lower insurance rates. On the other hand, individuals with lower credit scores may face higher premiums due to the perceived higher risk of making claims.

Claims History

The homeowner’s claims history also plays a crucial role in determining insurance premiums. Those with a history of frequent claims may be viewed as higher risk by insurance companies, leading to increased premiums. Conversely, individuals with a clean claims history may benefit from lower rates.

Age, Marital Status, and Occupation

Other personal factors such as age, marital status, and occupation can also affect home insurance premiums. Younger individuals may face higher premiums due to perceived higher risk, while married individuals may be viewed as more stable and responsible, leading to lower rates. Additionally, certain occupations may be associated with higher or lower risks, influencing the cost of insurance coverage.

Coverage options and their impact on premiums: Factors That Affect Home Insurance Premiums

When it comes to home insurance, the coverage options you choose can significantly impact your premiums. Understanding the types of coverage available, how deductibles affect costs, and the impact of adding endorsements or riders is crucial in managing your insurance expenses.

Types of coverage options

- Dwelling coverage: Protects the structure of your home from covered perils like fire or vandalism.

- Personal property coverage: Covers belongings inside your home, such as furniture, electronics, and clothing.

- Liability coverage: Helps protect you financially if someone is injured on your property.

- Additional living expenses coverage: Pays for temporary living arrangements if your home becomes uninhabitable due to a covered event.

Impact of deductibles

- Choosing a higher deductible typically lowers your premium, as you agree to pay more out of pocket before the insurance kicks in.

- While a higher deductible can save you money on premiums, make sure you can afford the out-of-pocket cost in case of a claim.

Adding endorsements or riders

- Endorsements or riders are additional coverages that you can add to your policy for specific needs, like jewelry or earthquake coverage.

- Adding endorsements or riders can increase your premium, but they provide extra protection for valuable items or events not covered by a standard policy.

In conclusion, understanding the various factors that affect home insurance premiums is essential for making informed decisions about your coverage. By considering these elements, you can navigate the insurance landscape more effectively and secure the right protection for your home.

Understanding liability coverage in home insurance is crucial for homeowners. This type of coverage protects you in case someone is injured on your property. To learn more about liability coverage, check out this comprehensive guide on liability coverage in home insurance explained.

Have you ever wondered what is covered under a home insurance policy? From structural damage to personal property protection, a home insurance policy offers various types of coverage. For a detailed explanation of what is covered, visit this informative article on what is covered under a home insurance policy?.

Protecting personal belongings is a key aspect of homeowners insurance. From jewelry to electronics, homeowners insurance provides coverage for your valuable possessions. To explore more about homeowners insurance for personal belongings, read this insightful article on homeowners insurance for personal belongings.