Basic homeowners insurance coverage explained: Starting off with a detailed insight into the fundamentals of homeowners insurance, this article aims to demystify the nuances of basic coverage and provide clarity on its significance for homeowners.

As we delve deeper into the realms of dwelling coverage, personal property coverage, liability protection, and additional living expenses coverage, readers will gain a comprehensive understanding of the key aspects that shape a robust homeowners insurance policy.

Basic homeowners insurance coverage

Homeowners insurance is a crucial protection for individuals who own a house. It provides financial security in the event of unexpected damages or losses. Understanding what basic homeowners insurance typically covers, its importance, and common exclusions can help homeowners make informed decisions.

What does basic homeowners insurance cover?

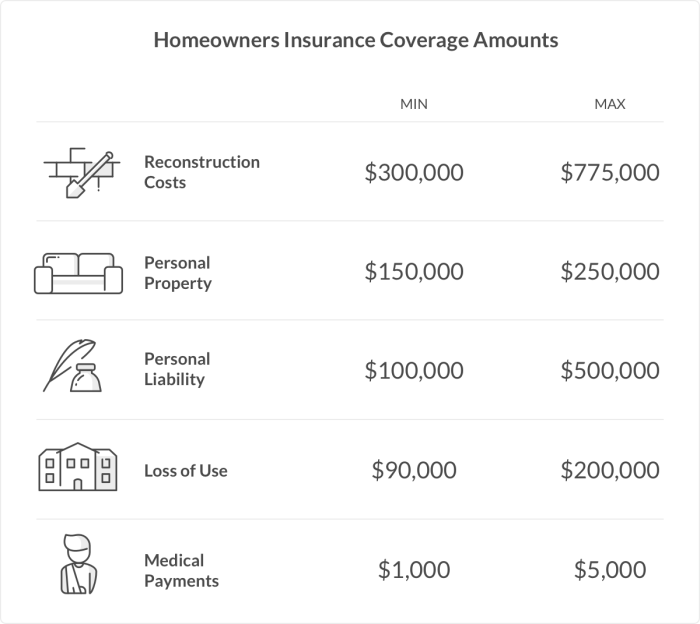

Basic homeowners insurance typically covers:

- Dwelling coverage: Protects the structure of your home from covered perils like fire, windstorm, or vandalism.

- Personal property coverage: Covers belongings such as furniture, clothing, and electronics in case of theft or damage.

- Liability coverage: Helps pay for legal fees and medical expenses if someone is injured on your property.

- Additional living expenses: Covers costs if you need to live elsewhere temporarily due to damage to your home.

Importance of having basic coverage for homeowners

Having basic homeowners insurance is crucial for homeowners because:

- It protects one of your most significant investments, your home, from unforeseen events.

- Provides financial security by covering repair or replacement costs for damages to your home or belongings.

- Offers liability protection in case someone is injured on your property and sues you for damages.

Common exclusions from basic homeowners insurance policies

Despite its coverage, basic homeowners insurance policies often exclude certain situations, such as:

- Floods and earthquakes: Typically not covered and require separate insurance policies.

- Home maintenance issues: Damages due to lack of maintenance or wear and tear are usually not covered.

- High-value items: Expensive jewelry, art, or collectibles may require additional coverage through a rider or separate policy.

Dwelling coverage: Basic Homeowners Insurance Coverage Explained

When it comes to homeowners insurance, dwelling coverage is a crucial component that protects the structure of your home. This coverage typically includes protection for the house itself, as well as attached structures such as a garage or deck.

Dwelling coverage provides financial protection against damage caused by covered perils, which can include events like fire, windstorms, hail, lightning, theft, and vandalism. In the event of a covered loss, the insurance policy will help cover the costs of repairs or rebuilding the damaged parts of your home.

What does dwelling coverage include and protect?

Dwelling coverage includes protection for the physical structure of your home, such as the walls, roof, floors, ceilings, and foundation. It also covers attached structures like a garage or porch. In addition to the main structure, dwelling coverage typically extends to other components of your home, such as plumbing, electrical systems, and HVAC systems.

Examples of situations where dwelling coverage would come into play

- If a tree falls on your roof during a storm and causes damage to the structure.

- In the event of a fire that destroys part of your home, dwelling coverage would help cover the costs of rebuilding.

- If a pipe bursts and causes water damage to your walls and floors, dwelling coverage would assist with repairs.

Comparing different levels of dwelling coverage

When it comes to dwelling coverage, homeowners have the option to choose different levels of coverage based on their needs and budget. Some policies may offer actual cash value coverage, which takes depreciation into account when determining the payout for a claim. Other policies may provide replacement cost coverage, which covers the cost of rebuilding or repairing your home without factoring in depreciation.

It’s important for homeowners to carefully review their policy and understand the level of dwelling coverage they have to ensure they are adequately protected in the event of a covered loss.

Personal property coverage

When it comes to homeowners insurance, personal property coverage plays a crucial role in protecting your belongings inside your home. This coverage helps reimburse you for the loss or damage of personal items such as furniture, clothing, electronics, and other possessions due to covered perils like theft, fire, or vandalism.

Difference from dwelling coverage

- While dwelling coverage protects the physical structure of your home, personal property coverage focuses on the contents inside your home.

- Dwelling coverage typically includes coverage for the actual building, including walls, roof, and foundation, while personal property coverage is designed to protect your belongings.

- Personal property coverage can be customized to fit your specific needs and the value of your possessions, unlike dwelling coverage which is based on the cost to rebuild the home.

Determining the appropriate amount of coverage, Basic homeowners insurance coverage explained

Determining the right amount of personal property coverage can be challenging, but there are a few tips to help homeowners make an informed decision:

- Take inventory of your belongings: Creating a detailed list of your possessions and their value can help you estimate how much coverage you need.

- Consider the total value of your belongings: Calculate the total value of your personal property to ensure you have enough coverage to replace them in case of a covered loss.

- Review policy limits: Make sure to review the limits of your personal property coverage in your policy to ensure it aligns with the value of your possessions.

- Consider additional coverage options: Depending on the value of your belongings, you may want to consider adding endorsements or scheduled personal property coverage to your policy for high-value items like jewelry or art.

Liability Protection

Liability protection is a crucial component of a homeowners insurance policy as it safeguards you financially in case someone is injured on your property or if you accidentally damage someone else’s property.

Importance of Liability Protection

- Liability protection can cover legal expenses if you are sued for bodily injury or property damage.

- It can provide financial protection if someone files a claim against you for an incident that occurred on your property.

- Without liability protection, you could be responsible for paying medical bills, legal fees, and damages out of pocket.

Examples of Situations Where Liability Protection is Beneficial

- If a guest slips and falls on your icy driveway during winter.

- If your dog bites someone while they are visiting your home.

- If a tree from your property falls onto your neighbor’s house and causes damage.

Coverage Limits and Options

Most standard homeowners insurance policies include liability protection with limits typically starting at $100,000. However, you can increase this coverage amount for an additional premium.

It is recommended to have enough liability protection to cover your assets and protect you from potential lawsuits.

Additional living expenses coverage

When a homeowner’s property becomes uninhabitable due to a covered peril, additional living expenses coverage comes into play. This coverage helps pay for the increased costs of living away from home while repairs are being made.

Scenarios where this coverage would be useful

- Temporary relocation: If a fire damages your home and you need to stay in a hotel while it’s being repaired, additional living expenses coverage can help cover the cost of accommodations.

- Increased food costs: If you need to eat out more frequently due to not having a kitchen to cook in, this coverage can help cover the extra expenses.

- Transportation costs: If you need to travel further to work or school due to the temporary relocation, this coverage can help with the additional transportation expenses.

How homeowners can determine the appropriate amount of coverage for additional living expenses

Determining the right amount of coverage for additional living expenses is crucial to ensure you are adequately protected. To calculate the appropriate amount, consider factors such as the cost of temporary housing, food, transportation, and other essential living expenses. Keep in mind the potential duration of displacement and any specific needs you or your family may have. It’s essential to review your policy limits regularly to make sure you have sufficient coverage in case of an unforeseen event requiring the use of additional living expenses coverage.

In conclusion, Basic homeowners insurance coverage explained encapsulates the essential components of homeowners insurance, empowering readers to make informed decisions when safeguarding their homes and possessions. By grasping the intricacies of coverage options and exclusions, homeowners can navigate the insurance landscape with confidence, ensuring comprehensive protection for their most valuable assets.

Are you looking to elevate your home décor? One way to transform your spaces is by using stylish rugs. Check out this guide on How to use rugs to elevate your home décor Transforming Spaces with Stylish Rugs for tips and inspiration.

Enhance the ambiance of your indoor spaces with houseplants. Greenery can add a touch of nature and freshness to your home décor. Learn more about Houseplants for indoor home décor Enhancing Your Space with Greenery to bring life into your living spaces.

Looking for trendy throw blankets to create cozy spaces in your home? Discover stylish blankets that offer ultimate comfort and warmth. Explore a variety of options in this guide to Trendy throw blankets for cozy spaces Discover stylish blankets for ultimate comfort.